- Bookkeeping

-

by pohoda

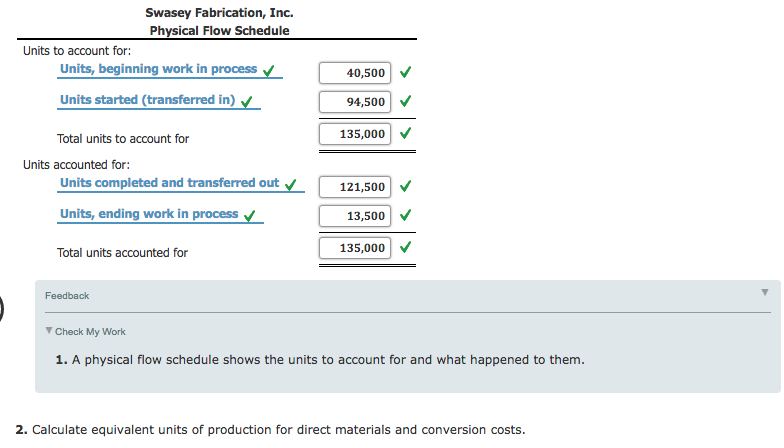

I assume materials are added at the beginning of the process, so ending WIP units are 100% complete with respect to direct materials and transferred-in costs. This report shows the costs used in the preparation of a product, including the cost per unit for materials and conversion costs, and the amount of work in process and finished goods inventory. A complete production cost report for the shaping department is illustrated in Figure 5.6. Once the total units have been reconciled, the equivalent units are computed. The correct manipulation of the data will depend on the inventory method in use.

Started and completed

- If you sum the three ending WIP products above, you have the total cost of ending WIP.

- So, the beginning WIP equivalent units are subtracted away in order to arrive at “Equivalent units completed with this period’s work” (see cells E4, E11, and E18).

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

The beginning step in computingDepartment B’s equivalent units for Jax Company is determining thestage of completion of the 2,000 unfinished units (rememberunits completed and transferred are always 100% complete). InDepartment B, the ending units may be in different stages ofcompletion regarding the materials, labor, and overhead costs.Assume that Department B adds all materials at the beginning of theproduction process. Then ending inventory would be 100% complete asto materials since we received all materials at the beginning ofthe process.

5.3 FIFO Step #3: Alternative Explanation (Additive Method)

We had to “top off” the beginning WIP units this period to complete them. And that top-off belongs to this period and gets this period’s rates. So the cost of beginning WIP, the first-in and first-out portion of the units completed and transferred out is reflected below. The weighted average firm just doesn’t care that some “completed did you have any interest or dividend income units” are actually beginning WIP units that already had some work done on them last period. Instead the weighted average method completely detaches beginning WIP costs from partially-complete beginning WIP units. Beginning WIP units get lumped in with all “Completed Units” as if they had no work at all done last period.

1.3 Complication #2: Non-uniform Consumption of Product Costs

For many process costing firms, there are units still in process when the month or quarter or year ends. Some overhead cost should go to these units still in WIP, just not a full unit’s worth of overhead costs. These units probably aren’t responsible for the same amount of overhead that fully complete units are. At the start of an accounting period a business has 2,000 units in beginning work in process. During the accounting period a further 8,000 units are added to the production process and 6,000 units are completed and transferred out, leaving an ending balance of 4,000 units in work in process.

Formula for Equivalent Units of Production

It shows that 650,000 units were transferred on to the Skim/Alloy Department, leaving 250,000 tons still in process. When goods are produced in a continuous process, how are costs to be allocated between work in process and finished goods? Accountants have devised the concept of an equivalent unit, a physical unit expressed in terms of a finished unit. When Department A is done with some product units and passes those units onward to Department B, then we credit the WIP-A account for the cost of those units and debit the WIP-B account for the cost of those units. Let’s update our overhead allocation equation to incorporate our first complication of equivalent units. For example, during the month of July, Rock City Percussion purchased raw material inventory of $25,000 for the shaping department.

For example, if we have 3 units 1/3 ofthe way complete, we can add them together to make 1 equivalentunit (1/3 + 1/3 + 1/3). We can make this calculation easier bymultiplying the units by a percentage of complete. The shaping department completed 7,500 units and transferred them to the testing and sorting department. No units were lost to spoilage, which consists of any units that are not fit for sale due to breakage or other imperfections.

Finally, the equivalent units of production calculated via the previous three steps should be aggregated to ascertain the total output in terms of equivalent units or equivalent production. Under FIFO, remember to bring over the costs of beginning work in process first, then multiply the individual equivalent units calculated in step 2 (not the total equivalent units) by the cost per equivalent unit from step 3. To illustrate more completely the operation of the FIFO process cost method, we use an example of the month of June production costs for a company’s Department B. Department B adds materials only at the beginning of processing.

This keeps beginning WIP costs out of ending WIP, since ending WIP is calculated by multiplying this period’s rates by ending WIP equivalent units. As for the equations, this means that beginning WIP costs can’t be included in total costs (i.e. in the numerator). What makes this method a “weighted average” is that performance last period affects costs in future periods (it will at least affect costs this period and next period). Let’s say the firm was not very cost-effective last period and $15,000 in beginning WIP is a lot of conversion costs for the 360 equivalent units in beginning WIP.

If those costs weren’t 100% complete, the product wouldn’t have been transferred out of that department! If you recognize this, you can simplify your transferred-in cost calculations somewhat. So when these firms allocate overhead, they also allocate direct materials and direct labor, i.e. all product costs. If the process is constantly being repeated across homogeneous units, then we can consider a unit’s percent completion as an indicator of how much of the process’s overhead costs that unit has incurred.

This is because are trying to calculate the total equivalent units of work completed this period, and beginning WIP equivalent units represent work done last period. I phrase this equation in the singular (i.e. “unit”), but process costing firms usually calculate equivalent units for groups of units, rather than for individual units. The implicit assumption is that all units in the group are roughly at the average same level of completion (process costing firms are very unlikely to find it useful to get more specific than that). This leads to process costing, which tries to allocate actual overhead costs equally across homogeneous individual product units. We want to make sure that we have assigned all the costs from beginning work in process and costs incurred or added this period to units completed and transferred and ending work in process inventory.