- Bookkeeping

-

by pohoda

If the firm takes the discount, an account titled Purchase Discounts will be credited for the amount of the discount. The vendor issues a Credit Memo anyway and we remove the items from inventory and dispose of them. Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. Please watch the video explanation for a full understanding of the differences between the two methods. Ultimately, it’s up to you to decide which one makes the most sense for your business.

Effect if cash discount not availed

In order to illustrate precisely accounting for purchase discounts, let’s assume that ABC Co purchases merchandise inventory from its supplier on November 02, 20X1 at the original invoice amount of $1,500. Businesses often seek efficient ways to manage their financial transactions, and accounting methods play a crucial role in this process. One such method is the net method of accounting, which focuses on recording purchases and sales at their net amounts after considering any available discounts. Gross method of recording purchase discounts is the method in which the purchase and the payable are recorded at the gross amount, before any discount.

Gross Method vs. Net Method (Seller Transactions)

By documenting the entire sales amount, companies can provide a clear and unambiguous record of their income-generating activities. The gross method thus fosters a level of trust and reliability in financial reporting that is essential for maintaining strong business relationships and securing future investments. One of the core tenets of gross method accounting is its emphasis on the initial transaction value. For instance, when a company sells goods or services, it records the total sales amount as revenue, without immediately accounting for any discounts or returns.

When should you use net method of recording purchase discounts?

If he pays half the amount In accounting, gross method and net method are used to record transactions of this kind. Another example involves service-based businesses, where the gross method can help in tracking the full value of services rendered. For instance, a consulting firm that bills clients $200,000 in a quarter would record this amount as total revenue.

How does the gross method of recording purchase discounts?

Moreover, the net method can improve the transparency of a company’s income statement. By recording sales and purchases at their net values, the revenue and expense figures are more aligned with the actual cash flows. This alignment helps in better matching revenues with expenses, a fundamental principle of accrual accounting. It also aids in more accurate profit margin calculations, as the recorded revenues and costs are closer to the actual amounts that will be realized.

- Under the gross method, the revenue section will display the total sales amount without any deductions for discounts or returns.

- For instance, calculating gross profit requires subtracting the total cost of goods sold from the total revenue.

- Lastly, at the time of making payment (failing to get the advantage of cash discount), the journal entry to record the payment under both net and gross method are the same.

- The Gross Method helps to provide accurate financial information by making sure payment amounts reflect reality, rather than showing inflated sales figures or artificially lowered expenses.

Net Method of Recording Purchase Discounts FAQs

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

The credit terms that are put forth by Blenda Co. mean that Dolphin Inc. is supposed to settle the amount due before 10th January to avail a cash discount of 5%. Both methods give businesses the information they can use when making decisions on future purchases; knowing which type is right for a business depends on the company’s purchasing goals and needs. This is because the amount of accounts payable that the company needs to make payment to the supplier under both methods is at the same amount. This includes the illustration of the net method vs gross method of recording purchase discounts both under the perpetual inventory system and periodic inventory system.

The net method assumes that the buyer will pay within the discount period, and acknowledges the discount on the date of the initial sale. The main drawback to using the net method is that it does not record any information about the discounts taken or when they were taken. This means that if there is an audit, it will be difficult to prove that the discounts have been properly accounted for how much are taxes for a small business and recorded. Additionally, it may result in overstating profits by not recognizing any purchase discounts at the time of payment. Explore the principles, impact, and comparisons of gross method accounting, and understand its effect on financial statements and revenue recognition. In this method, vendor does not make the assumption that the customer will prepay and avail the cash discount.

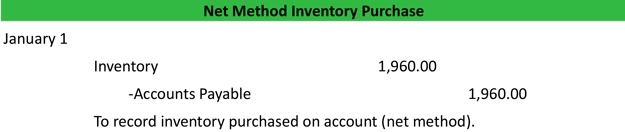

Net method of recording purchase discounts is a method of recording purchase discounts in which the purchase and accounts payable are recorded at the net of the allowable discount. Gross method accounting revolves around the principle of recording transactions at their full value before any deductions or allowances are applied. This approach ensures that the initial transaction amounts are fully transparent, providing a clear picture of the company’s gross revenue and expenses. By capturing the total value of sales and purchases, businesses can better track their financial activities and understand the true scale of their operations. Net method accounting revolves around the principle of recording transactions at their net value, which means after deducting any potential discounts. This method is particularly useful for businesses that frequently engage in transactions where discounts are offered for early payments.